Why some defense contractors perform better than others during a pandemic

Speaking Security Newsletter | Advisory Note for Organizers and Candidates, n°58 | 30 November 2020

*Unrelated note: SPRI published a policy paper today on ending the US’ forever war in Syria (article link | twitter link). Please read/share!

Situation

The US Aerospace & Defense sector as whole took a hit from the pandemic:

Mixed results from major war industry players

There are about 50,000 defense contractors. Many of them have commercial divisions (in addition to selling goods/services directly to DOD via contracts) that were affected by the public health crisis. For example, Boeing posted losses in the second and third quarter of 2020, probably because 60 percent of the global aviation fleet was grounded during the pandemic.

But other major defense contractors did just fine, like Lockheed Martin (+9 percent revenue growth from Sept. 2019 to Sept. 2020) and Northrop Grumman (+7 percent).

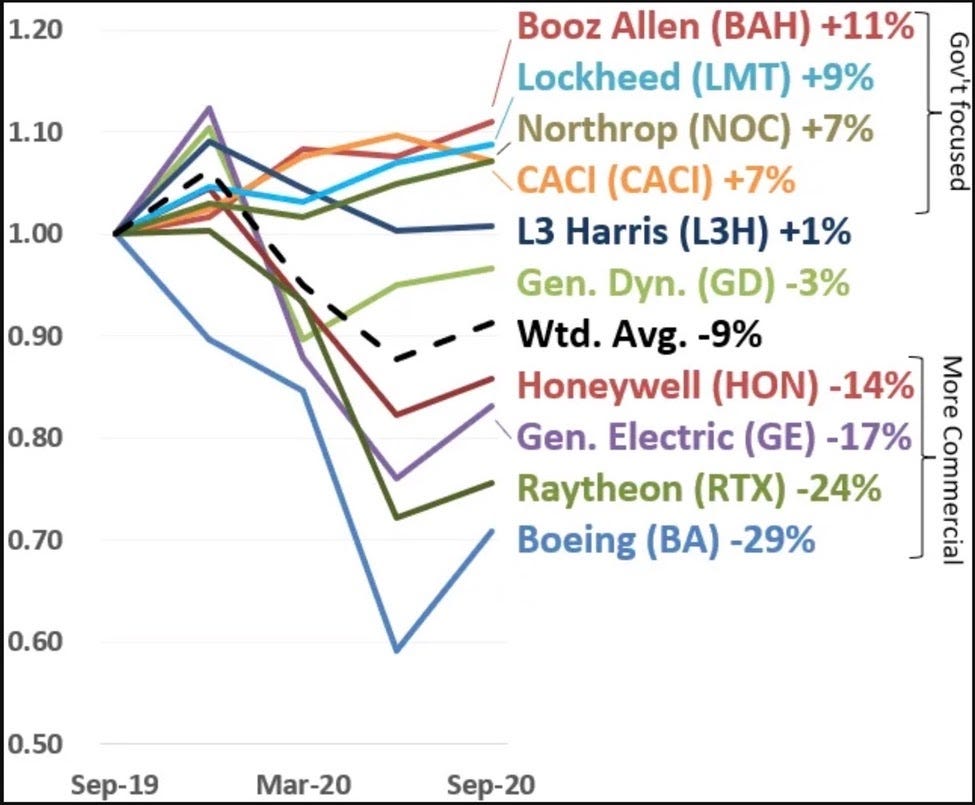

Contractors more reliant on government contracts had an easier time in 2020

Here’s a graph from Acquisition Talk of some of the top defense contractors with their revenue trajectories from Sept 2019 to Sept 2020. The companies that generate revenue primarily from government contracts (labeled “Gov’t focused” in the graph below) had stable or growing revenue during this period. The companies more reliant on the private sector (“More Commercial”) took losses.

For defense contractors, corporate profits depend on public welfare

A breakdown of the graph above:

Booz Allen, Lockheed, Northrop, and CACI did quite well.

Average share of company revenue derived from US government contracts (2019): 70 percent

L3 Harris and General Dynamics did OK.

Average share of company revenue derived from government contracts: 56 percent

Honeywell, General Electric, Raytheon* and Boeing did poorly.

Average share of company revenue derived from government contracts: 19 percent

*Raytheon (that has a small commercial sector) recently merged with United Technologies (that has a large commercial sector), hence Raytheon’s operating losses.

Conclusion

The chart above shows just how reliant war corporations are on public subsidies. So a nationalized defense industry isn’t that hard to imagine because it basically already is. The fight now is to move nationalization from being interpreted as a cool, radical idea to one that’s treated more as a matter of course.

Thanks for your time,

Stephen (@stephensemler; stephen@securityreform.org)

Find this note useful? Please consider becoming a supporter of SPRI. Unlike establishment think tanks, we rely exclusively on small donations.